United Overseas Bank

Building a portfolio that performs with purpose

The UOB Sustainable Investing page aims to educate investors that purposeful companies are proven to be financially resilient and able to achieve long-term financial success. In their words, “Doing good for society does not come at the expense of returns. Organisations across sectors are finding that operating sustainably, in line with public opinion, comes hand-in-hand with profits and business growth”.

The Sustainable Investing page, marketed to 3 of UOB’s customer segments, empowers investors to do good, and to do well.

From Sustainability Knowledge to Sustainability Decisions

Black Sun worked with UOB Bank, the 3rd largest bank in Southeast Asia by total assets, to build a page to explain why sustainability matters, what sustainable investing is, and introduce UOB’s selection of investment solutions.

A trivia quiz was developed to help customers test their understanding of global sustainability issues. Investors are taken through a primer on environmental, social and governance (ESG) considerations and how they can be used to enhance traditional investment decisions.

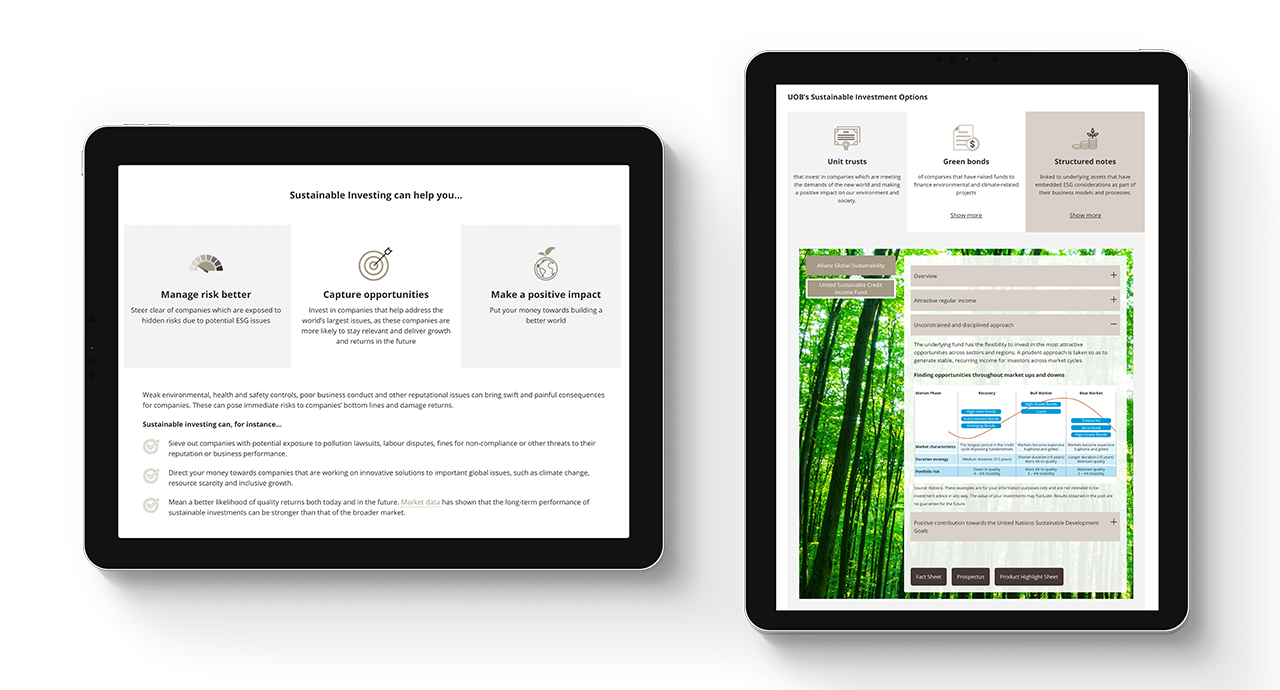

UOB’s Sustainable Investment options are featured, including unit trusts, green bonds and structured notes that have embedded ESG considerations as part of their business models and processes. This is aligned with the UOB Risk-First approach that enables investors to optimise their wealth portfolio according to their willingness and ability to take risks. By selecting investments suitable for each individual’s profiles, goals and risk appetites, it is possible to build a portfolio that performs with purpose.