United Overseas Bank

Helping customers gain greater financial clarity

UOB wanted to create a robust wealth content hub to showcase their expertise in the Investments, Bancasurance and Advisory space. Target audience ranges from customers in the mass market to high-net-worth individuals in private banking.

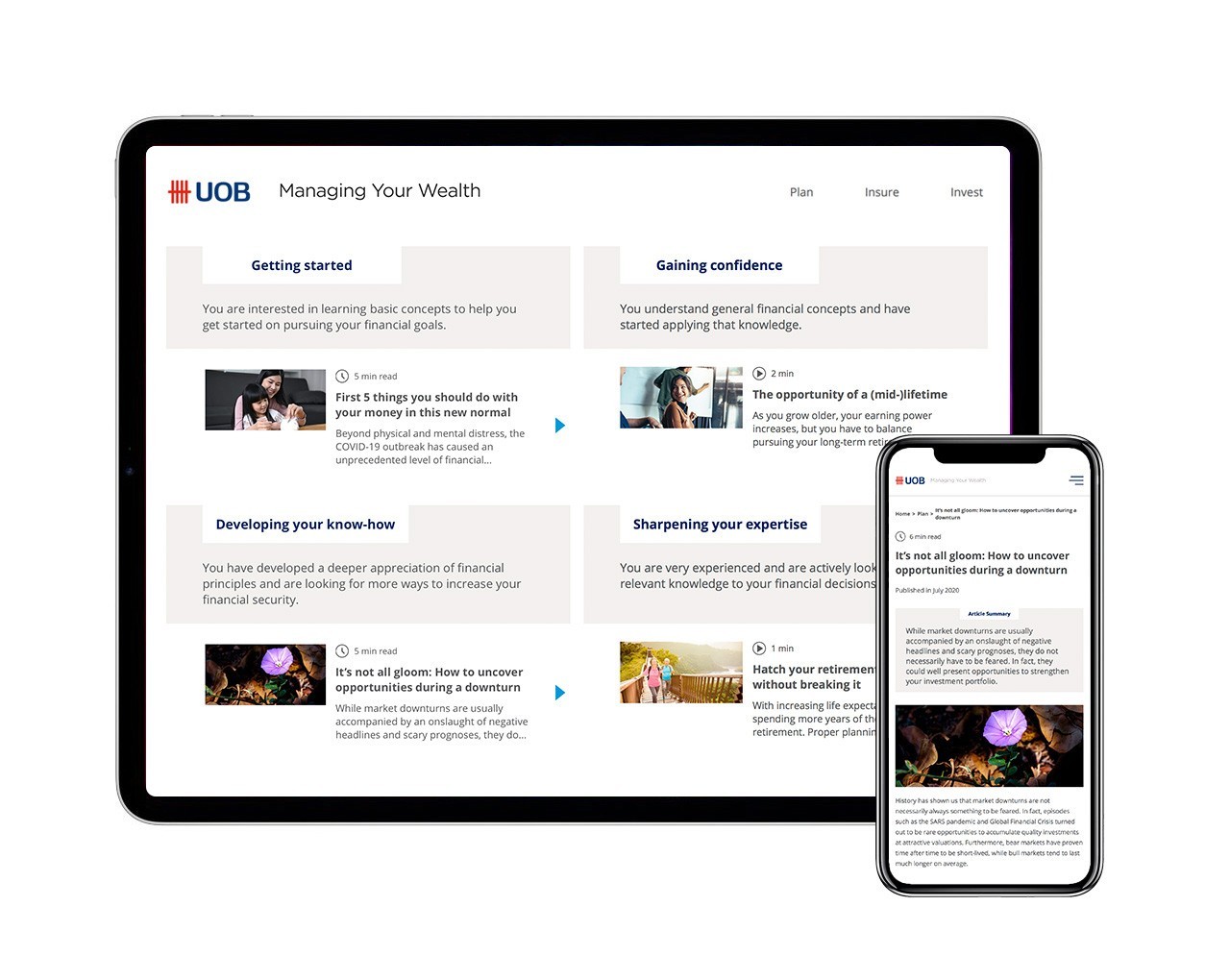

The content strategy is to break down complex financial concepts into easy-to-grasp language and provide readers with the clarity and guidance they need to make informed financial decisions. Content has been carefully curated to cater to each customer persona's financial goals, level of financial savviness and life stages.

UOB wanted to create a robust wealth content hub to showcase their expertise in the Investments, Bancasurance and Advisory space. Target audience ranges from customers in the mass market to high-net-worth individuals in private banking.

The content strategy is to break down complex financial concepts into easy-to-grasp language and provide readers with the clarity and guidance they need to make informed financial decisions. Content has been carefully curated to cater to each customer persona's financial goals, level of financial savviness and life stages.

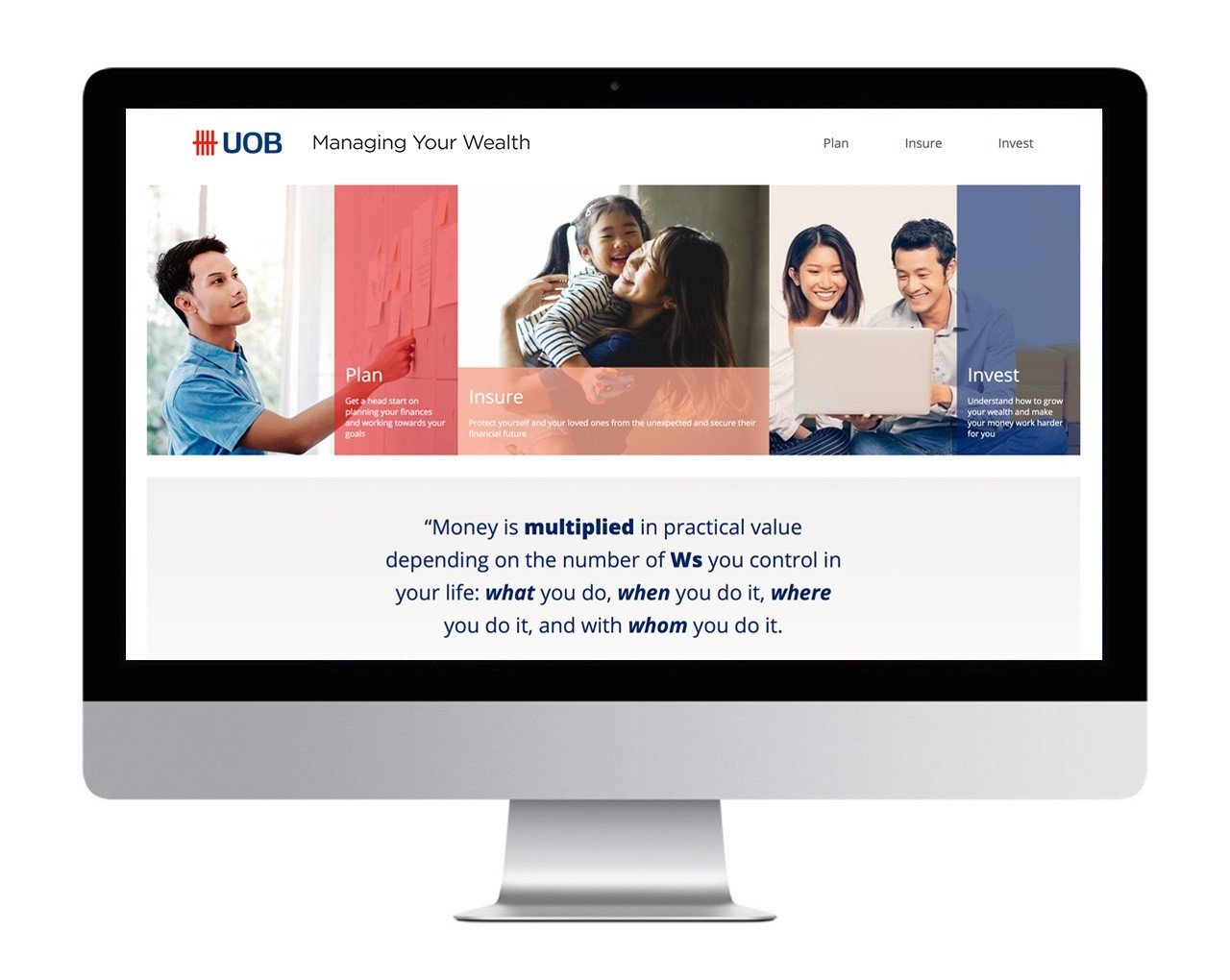

A financial content hub for everyone

To allow readers to easily find content that appeals to them, we have categorised content into 3 pillars: Plan, Insure, Invest.

- The Plan pillar comprises articles about basic financial concepts and principles.

- The Insure pillar comprises articles that seek to help readers understand how insurance can help them save towards important life milestones, as well as secure the financial future of their loved ones.

- UOB's wealth advisory approach focuses on getting their customers' assets safeguarded before moving on to grow their wealth. Therefore, the Invest pillar comprises a collection of content pieces tailored to individual's investment objectives and risk appetite.

Modern web design optimised for browsing across devices

While we retained UOB's corporate branding guidelines, we also wanted to design a microsite that has a tide of purposeful white space, clear visual hierarchy and intuitive navigation.

We also made use of card designs so it's easy for readers to quickly browse through the library of articles.

Leads generation for the bank

There is a call-to-action at the end of each article that drives traffic to the main UOB website.

Upon clicking on the button, readers are directed to a Contact Us form to express their interest for the bank to reach out to them.

By creating content that is useful to customers, the content hub doubles as a leads generation tool to nurture both new and existing customers into prospects.